audit vs tax quiz

Its less competitive to get into Big 4 tax since less people like tax -Hours still suck -Less client-interactions until senior levels -Some say taxes are boring although to be fair audit isnt very. Sounds boring or Im not sure.

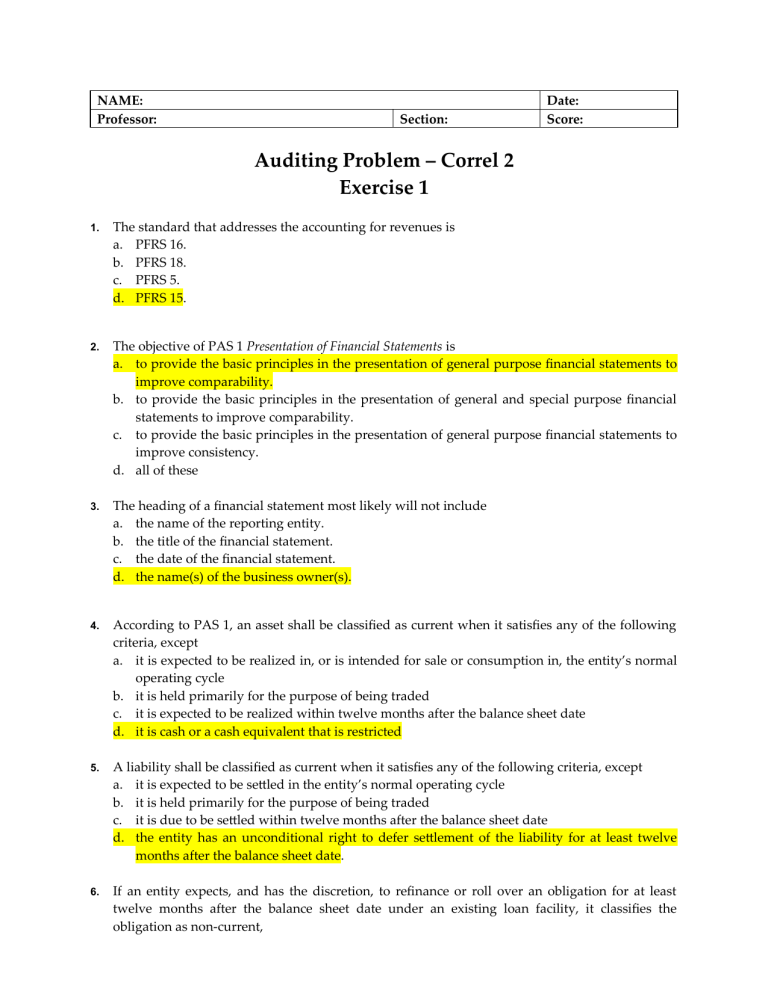

Pdfcoffee Com Aud Quiz 1 Pdf Free

Its going to come down to personal preference.

. 1 point for each question. Tax knowledge can be applied to more industries ie. No points will be given for skipped questions.

To lay a burden upon. Youre exits are pretty much any accounting role. Round numbers like 10000 dont often occur in the world of income and deductions and if your tax return is.

To subject to the payment of a tax or taxes. Answer Dislike if you tell yourself Ugh. Especially to exact money from for the support of government.

There are few letters more dreaded than one telling you youre being audited. The key difference between tax accountants and auditors is that tax accountants specialize in helping businesses and individuals plan for minimize and file taxes while auditors ensure that accountants work is correct and following the law. Deciding whether to specialize in audit or tax is a choice that college accounting majors need to make once they start their careers.

Answer Okay if you tell. However with proper preparation there should be little to fear. If youre quieter shy and are more of a homebody then go into tax.

Audit vs tax quiz Saturday March 26 2022 Edit. The top 10 percent of workers can expect to earn 118930 per year. However if youre rounding in larger amounts such as from 72 to 100 you can expect to get some questions.

Get your experience typically two years before getting your CPA license. Youre going to have to know yourself. Dislike Okay and Like.

Take our quiz to see if you know how to prepare for an impending audit -- and how you can keep the tax man away in the future. Its called a learning experience you learn from it and you move on to something better. Taxation is more specialized and the hours are more predictable while auditing could get more intense in terms of the work hours and needing to get things done on time.

Also the sheer volume of work that goes into auditing a public company and the vast number of transactions that would occur could become stressful. However these are far from the only examples and there are many more varied options on offer. To examine and adjust as an account or accounts.

If you can do both. As to audit the accounts of a treasure or of parties who have a suit depending in court. The key difference between tax accountants and auditors is that tax accountants specialize in helping businesses and individuals plan for minimize and file taxes while auditors ensure that accountants work is correct and following the law.

You are not tied down to only working in tax or only working in audit your entire career. Select quiz lenght ie. Some of the more popular accounting positions include.

Audit entry pays less than tax but allows for far more exit opportunities since you arent as niche youre exposed to all aspects of a business. There are 3 answers to each question. With strong outlook and salary opportunities many business-minded individuals are interested in pursuing a career in.

Salaries in the accounting field are attractive as well with the median annual wage for accountants and auditors at 67190. In this career quiz there are 10 questions that will give you a pretty good perspective on whether the career of an Auditor is right for you. MA etc Its easier to open your own shop and theres good money to be made helping HNWIs save money on taxes.

Tax because I feel like you are adding value by helping clients save taxes and can help family and friends with taxes and you can also start your own practice with those skills. Neither Id say is easier or have significantly better schedulesseasons in the grand scheme of total hours worked. In fact its rare now to work at one place or even one industry until retirement.

I discovered tax after spending 5 years in audit working with a fortune 100 company and then private companies and government audits. The IRS does allow for certain instances of rounding on a tax return say from 7298 to 73 or from 7212 to 72. If youre outgoing very personable and you like to travel I highly recommend you do audit.

They may instinctively have a sense for which discipline is the better fit with their personality and career goals. They may instinctively have a sense for which discipline is the better fit with their personality and career goals. The reason I chose to practice under audit rather than tax is the change in scenery.

For some the choice is easy. How should I choose between tax and audit. Online practice test on Audit Taxation.

Or their internships have given them enough information to guide. If youre outgoing very personable and you like to travel I highly recommend you do audit. To impose a tax upon.

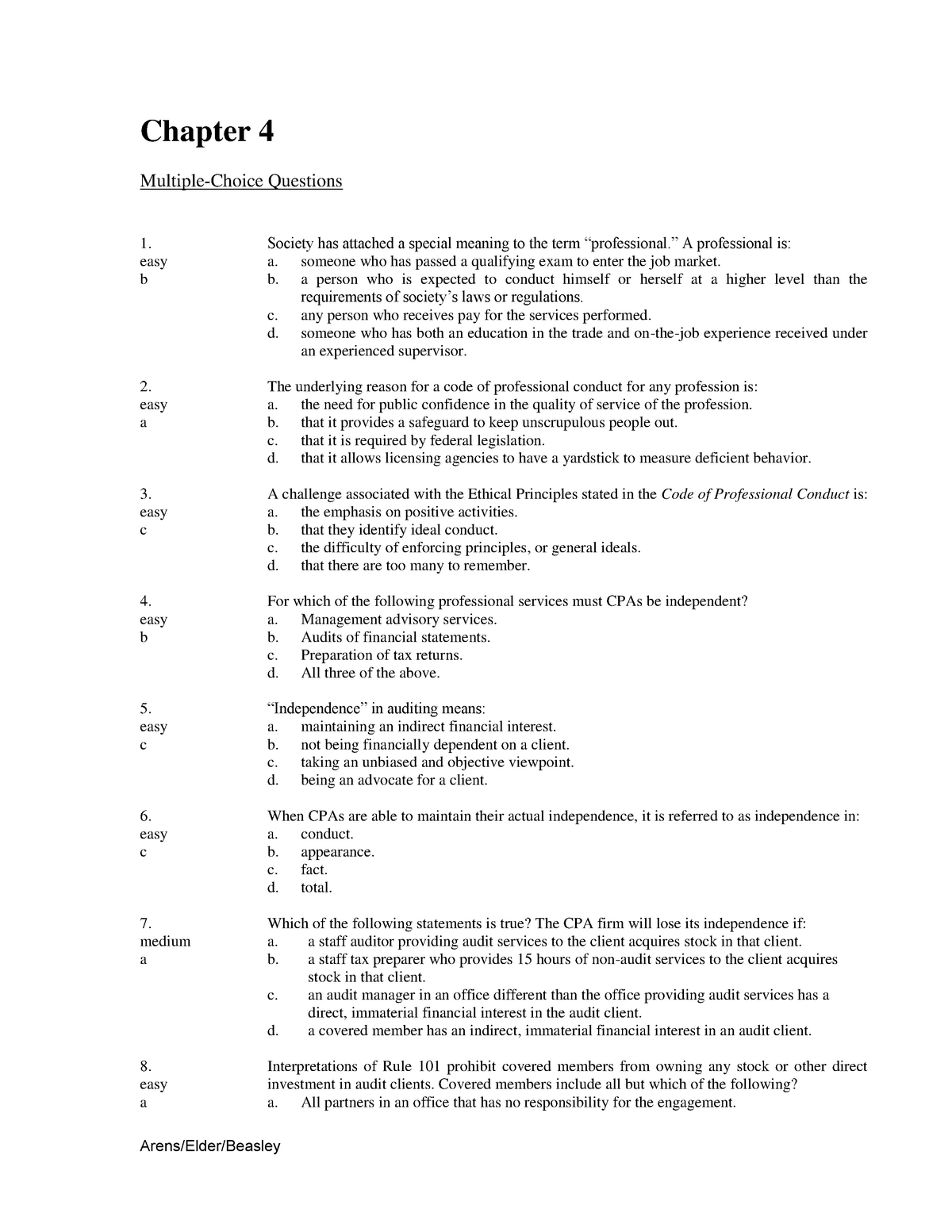

Chapter 4 Final Auditing And Assurance Test Bank Ch 4 Chapter 4 Multiple Choice Questions Studocu

Audit Announcement Memorandum Template Download This Audit Announcement Memorandum Template And After Downloading Memo Template Memorandum Template Templates

Doc Audit Theory Quiz 1 Reychelle Arimado Academia Edu

Auditing Chapter 1 Questions Pdf Auditor S Report Audit

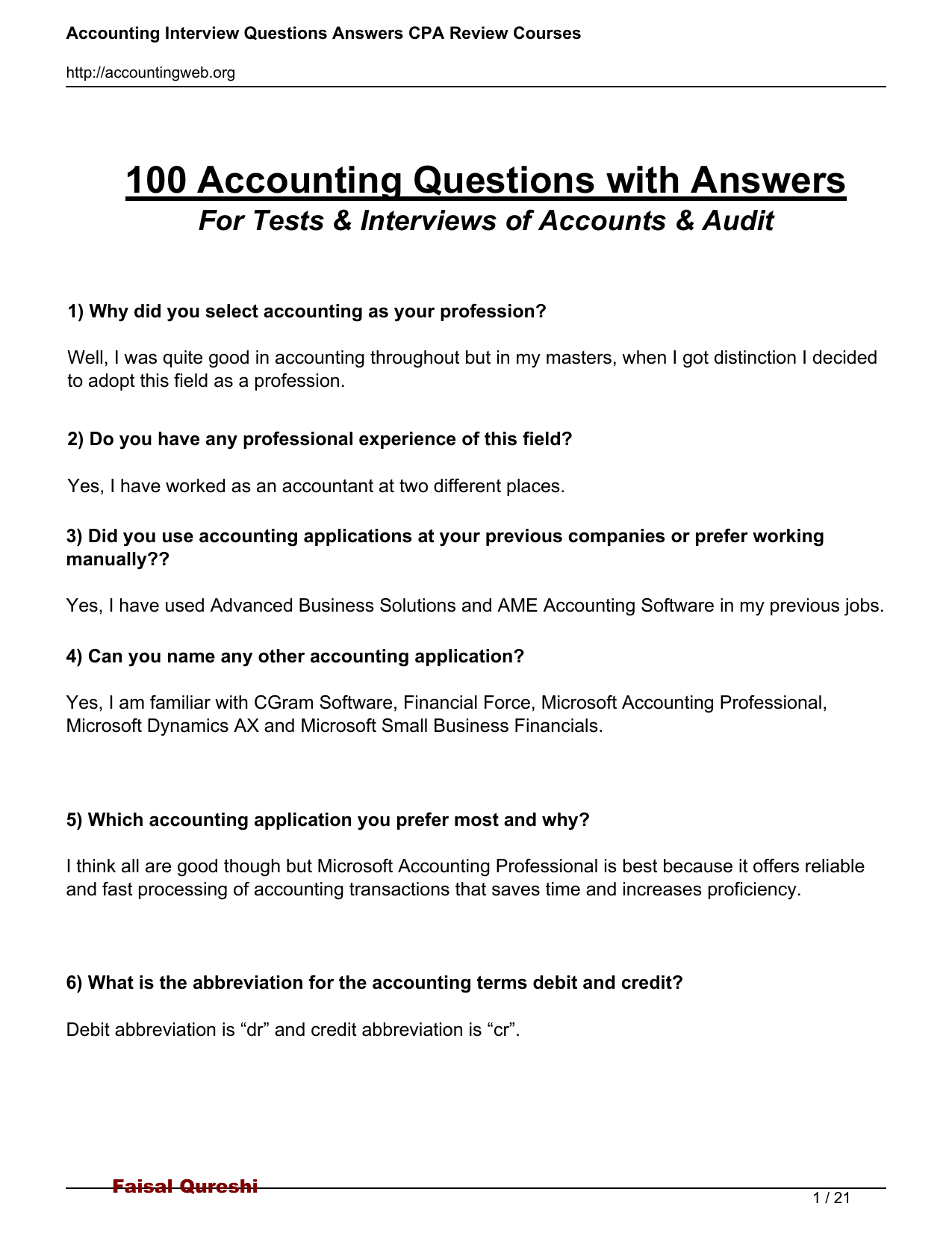

100 Test Interview Questions Audit Accounts Mcqs

Marketing Mcq Audit Services Accounting Services Business Valuation

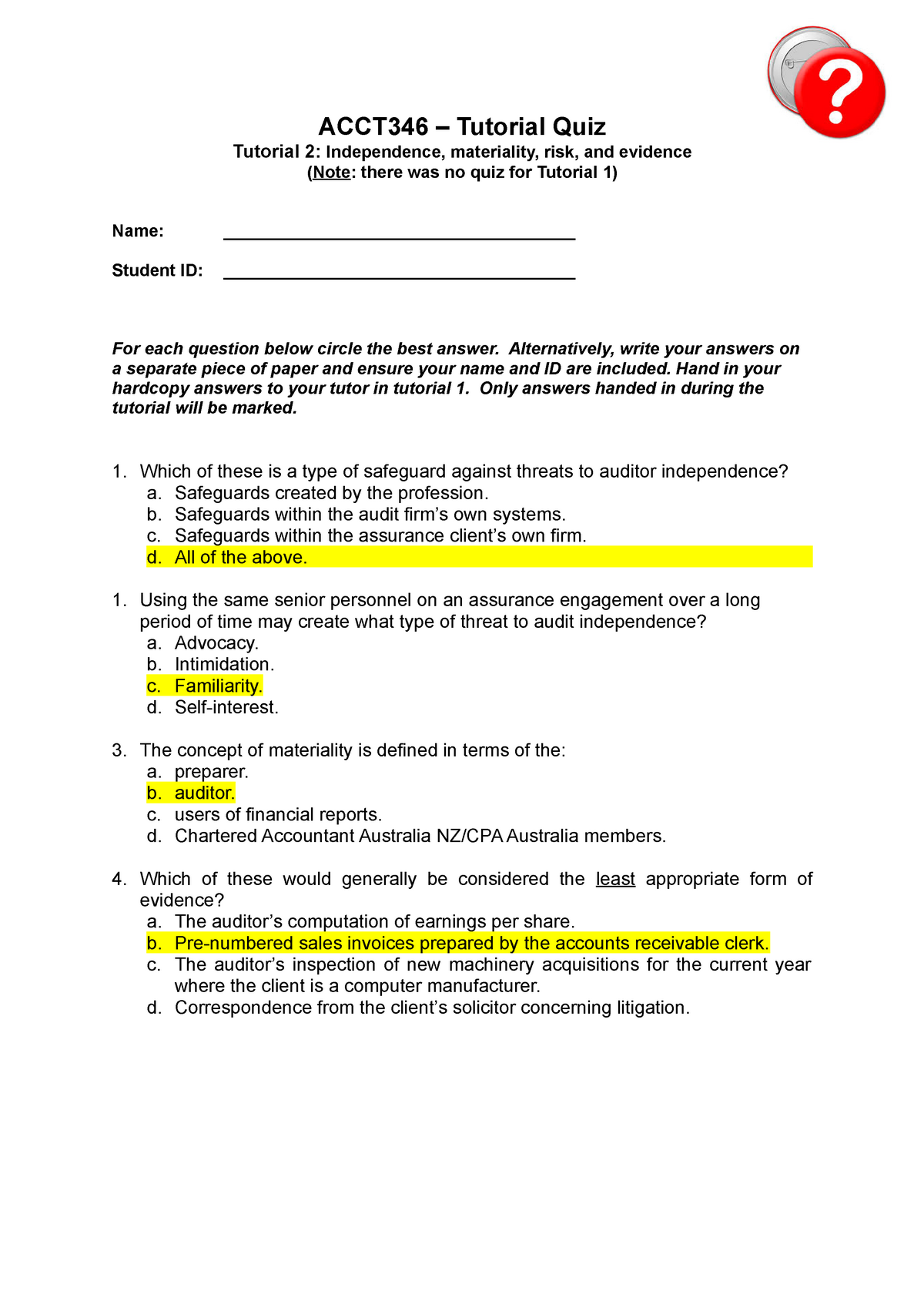

Quiz For Tutorial 2 Acct346 Tutorial Quiz Tutorial 2 Independence Materiality Risk And Studocu

100 Experimentos Sencillos De Fisica Y Quimica Salt Chemistry Water Reading Publishing Inbox Screenshot

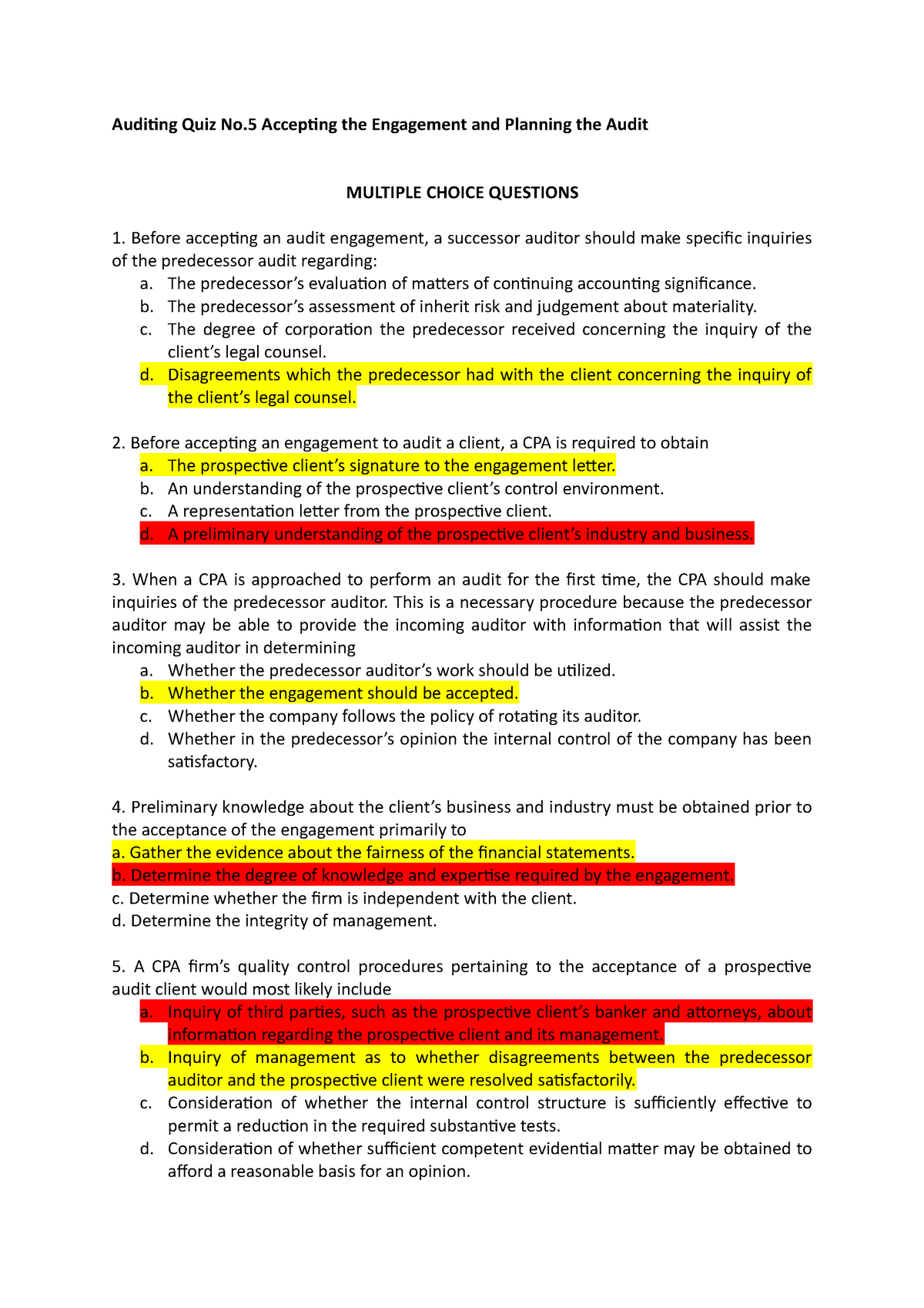

Exam Questions And Answers Audiing Quiz No Acceping The Engagement And Planning The Audit Studocu

Daily Current Affairs 7th Aug 2020 Current Affairs Quiz Data Science Science And Technology

7 Steps To Be A Successful Accountant Accounting Classes Apply For College Success

Quiz Worksheet Financial Audit Study Com

Pin On Universal Management Accounting

Trivia What Is The Acronym That Is Used By All Accountants In Terms Of Accounting Principles Accounting Principles Accounting Education Financial Accounting

Acc 305 Final Exam Part 1 Inventory Accounting Federal Income Tax Cost Of Goods Sold